Our eToro Review for 2026

If you're looking for a versatile and user-friendly online broker to trade a wide variety of assets, including cryptocurrencies, stocks, forex, and commodities, then eToro may have caught your attention.

We have tested and rated eToro, to create a comprehensive review that highlights the pros and cons of eToro, which may help you determine whether eToro is a good trading platform for you.

What is eToro?

Founded in 2007, eToro is a global trading platform with branches all around the world that offers simple trading of cryptocurrencies, stocks, ETFs, Metals, Forex, and more.

Besides offering easy trading that makes investing accessible to beginners, eToro popularized the concept of Social Trading, which allows users to copy the portfolios of other, more experienced traders on eToro.

Today, eToro is one of the biggest online trading platforms with roughly 30 million users that buy and sell all sorts of assets ranging from stocks at 0% fees to a wide selection of 134+ different cryptocurrencies on eToro.

On eToro, one can get started investing through an easy trading interface on both Desktop as well as mobile apps for Android and iOS, making this broker a great entry point for aspiring stock and crypto investors.

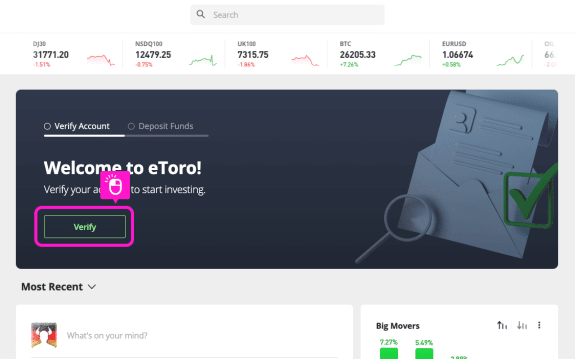

Registering on eToro

In order to start trading on eToro, users must first create a new account on eToro's registration page.

Registering on eToro is possible via Google, Facebook, or the traditional way of entering an email and password, and the entire process doesn't take more than a few minutes.

Being a global investment platform, eToro accepts users from over 82 different countries worldwide, which is one of the major pros of eToro, as most users across the globe will be able to register on the broker's platform.

| eToro Accepted Countries |

|---|

| 🇦🇪 United Arab Emirates, 🇦🇷 Argentina, 🇦🇸 American Samoa, 🇦🇹 Austria, 🇦🇺 Australia, 🇧🇩 Bangladesh, 🇧🇪 Belgium, 🇧🇬 Bulgaria, 🇧🇭 Bahrain, 🇧🇴 Bolivia, 🇧🇷 Brazil, 🇨🇭 Switzerland, 🇨🇱 Chile, 🇨🇴 Colombia, 🇨🇷 Costa Rica, 🇨🇾 Cyprus, 🇨🇿 Czech Republic, 🇩🇪 Germany, 🇩🇰 Denmark, 🇩🇴 Dominican Republic |

eToro KYC

As a regulated broker, eToro requires users to perform KYC verification by providing personal information to fully activate their eToro account after registration.

eToro is pretty customer-friendly in regards to KYC verification, as many users only have to answer some basic questions to get started trading on eToro, without having to complete long-lasting identity verifications.

Practically speaking, after you register on eToro, you will be prompted to verify yourself, which either includes

📃 answering some basic questions about yourself and your investing experience (a few minutes)

🤳 💳 or uploading pictures of your ID document to prove your identity and address (a few hours-days)

The exact eToro KYC process may differ depending on your country of residence, but it's straightforward and explained well on eToro.

When I personally registered to test eToro, I only had to answer some personal questions in order to get started trading. This initial KYC process to activate my eToro account only lasted ~10 minutes.

As a test result, eToro has received a rating of 93/100 for speed and ease of registration in this eToro review.

Is eToro legitimate?

eToro has many branches around the world and is regulated by local authorities that oversee eToro's operations in order to offer a legitimate trading platform in all those regions.

This means that in the vast majority of countries that are available on eToro, users will benefit from regulatory safety and consumer protection for all assets except spot cryptocurrencies.

A listing of regulators that oversee eToro's trading platform and make eToro legitimate can be seen in the table below.

| Region | eToro Entity | Regulated By |

|---|---|---|

| 🇪🇺 Europe | eToro (Europe) Ltd | Cyprus Securities Exchange Commission (CySEC) |

| 🇬🇧 United Kingdom | eToro (UK) Ltd | Financial Conduct Authority (FCA) |

| 🇺🇸 United States | eToro USA Securities Inc. | Securities and Exchange Commission (SEC) |

| 🇺🇸 United States | eToro USA LLC | FinCEN |

| 🇦🇺 Australia | eToro AUS Capital Limited | Australian Securities & Investments Commission (ASIC) |

| 🇸🇨 Seychelles | eToro (Seychelles) Ltd. | Financial Services Authority Seychelles (FSAS) |

Because eToro offers risky CFD trading in certain regions, eToro is often viewed critically. But even in this regard, eToro provides many disclaimers and lots of educational material which shows that eToro takes a responsible approach even to risky investing products.

With a long record of operations ranging back to 2007, eToro has already been through some global financial crises without being involved in any scandals that could cast doubt on the legitimacy of eToro, making this broker highly trustworthy.

Summing up, being a broker that is regulated in many regions worldwide, eToro makes an overall legitimate and trusted platform for trading cryptocurrencies, stocks, commodities, and more.

eToro Security and Insurance

In addition to eToro's wide set of regulations through many authorities worldwide, eToro also implements important security features on its platform that make investing on eToro a secure process.

When it comes to the protection of user funds, eToro claims to store user funds in separate bank accounts that remain untouched in the case of eToro's bankruptcy.

"Every penny deposited by a client is held in a separate, segregated account. This means that even in the highly unlikely event of eToro’s bankruptcy, your funds will be safe."

Furthermore, investors of eToro may be subject to extra insurance from both their local government as well as eToro's partner Lloyd’s of London which provides free insurance for eToro club members of level Platinum+ and above.

| Europe Insurance | UK Insurance | Australia Insurance | |

|---|---|---|---|

| Real Stock, ETFs, Cash | €20.000 from ICF + up to €1.000.000 in private insurance | £85.000 from FCFS | Up to 1.000.000 AUD in private insurance |

| CFDs | €20.000 from ICF + up to €1.000.000 in private insurance | £85.000 from FCFS | Up to 1.000.000 AUD in private insurance |

| Real Cryptoassets | €0 | £0 | 0 AUD |

Regarding platform security, eToro implements account-related security features that make the process of trading on eToro relatively secure, such as:

2FA login to prevent unauthorized account access

Limited cashouts to bank accounts with your name to prevent fraud

Also, because eToro is regulated by many authorities worldwide, the broker is being monitored and audited, making eToro a transparent and secure investing platform overall.

eToro Payment Methods

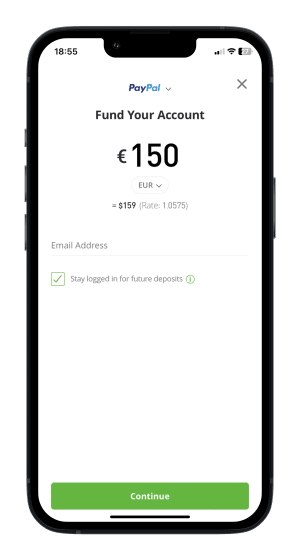

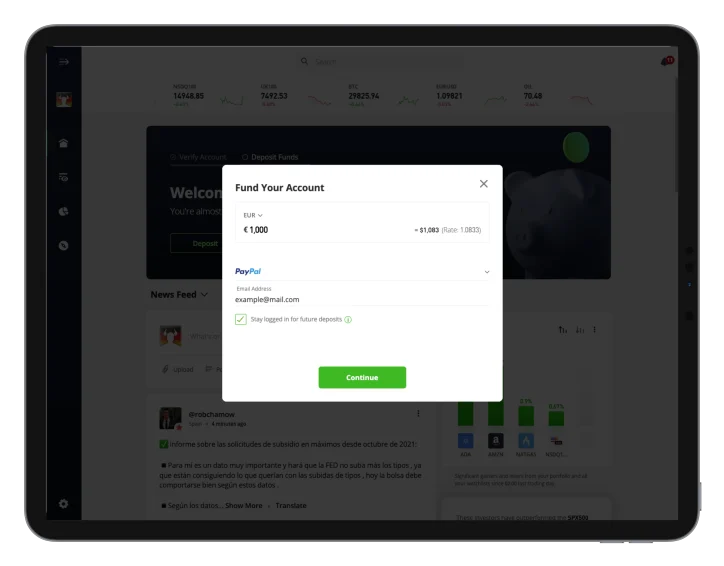

One major aspect that makes trading crypto and other assets on eToro so popular is eToro's wide selection of payment methods that go far beyond what you usually see from other brokers or cryptocurrency exchanges.

On eToro, investors can deposit with PayPal, credit card, Skrill, and many more with instant speed and at low fees.

For most countries, the initial deposit on eToro must be between $10-100 for third-party payment methods, while bank deposits require minimum deposit amounts of $500.

| Accepted Currencies | Speed | Minimum* | |

|---|---|---|---|

| Bank Transfer | USD, GBP, EUR | 4-7 days | $500 |

| Credit/Debit Cards | USD, GBP, EUR, AUD | Instant | $10-100 |

| PayPal | USD, GBP, EUR, AUD | Instant | $10-100 |

| Skrill | USD, GBP, EUR | Instant | $10-100 |

| Klarna/Sofort | EUR | Instant | $10-100 |

| NETELLER | USD, GBP, EUR | Instant | $10-100 |

| POLi | AUD | Instant | $50 |

| Giropay, EPS | EUR | Instant | $10-100 |

| RAPID TRANSFER | USD, GBP, EUR | Instant | $10-100 |

| Przelewy 24 | PLN | Instant | $100 |

If you deposit currencies other than USD on eToro, there will be a small conversion fee charged by eToro's payment processing partner - but we believe that's better than not accepting foreign currencies at all as many other brokers do.

Also, something important to point out is that eToro doesn't accept payments from accounts that aren't registered in your name.

eToro's exceptionally wide range of accepted payment methods, and most importantly PayPal, are one of the major advantages of eToro that we found in this eToro review.

A minimum deposit of $500 for bank transfers on eToro is rather High. Also, certain countries like New Zealand have a minimum deposit of $1000 for any payment method, and Isreal even $10.000, which is far from customer friendly.

eToro Tradable Assets

eToro is a multi-asset investing platform that offers trading for basically all assets, including Cryptocurrencies, CFDs, Crypto Indices, Derivates, ETFs, Forex, Precious Metals, and Stocks.

In practice, when trading on eToro, users have the option to either purchase actual assets from the spot market, or so-called CFDs that allow for shorting and leverage trading on eToro:

When opening a "Buy" (long) position with a leverage of x1 users on eToro buy the actual, underlying asset on the spot market.

By opening either a Forex or short position or using leverage of at least 2x, users buy CFDs on eToro that only follow the price of the asset but do not purchase the underlying rights.

Given the ability to trade either trade on traditional spot markets or the riskier CFDs, eToro is very flexible and suitable for both beginners and more advanced traders.

Note: CFDs are very risky and are not offered to eToro customers from the USA

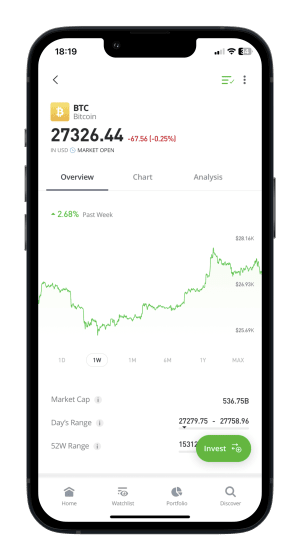

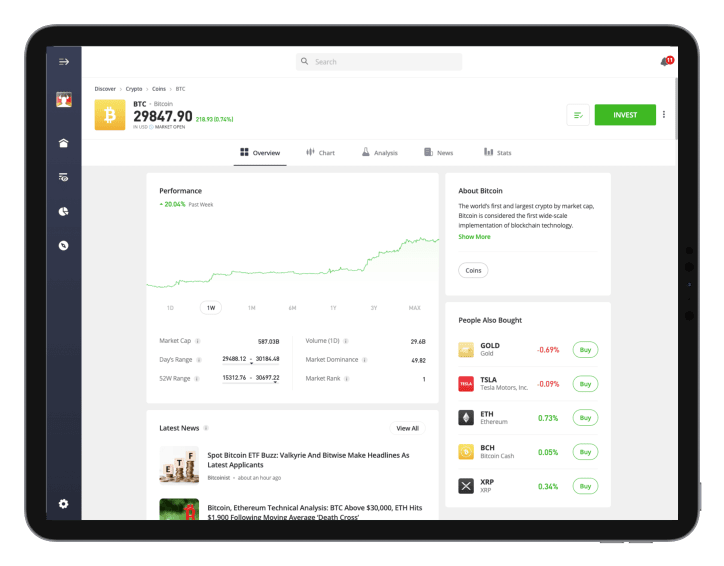

Cryptocurrencies on eToro

eToro offers a growing selection of 134+ tradable cryptocurrencies on their platform, which includes all major coins like Bitcoin, Ethereum, Carano, Solana, and more.

Cryptocurrencies on eToro can be traded at a fixed 1% fee on the spot market and even withdrawn to your personal crypto wallet for a small service fee.

Although eToro does not have the biggest altcoin selection, we're convinced that the vast majority of crypto investors won't miss their favorite cryptocurrencies on eToro.

For the cryptocurrencies available for trade on eToro, we have given eToro a rating of 90/100 in this eToro review.

Because eToro constantly expands its offered cryptocurrency selection, we believe eToro is a good broker for crypto investors looking for a reliable long-term crypto broker.

An important caveat regarding eToro's cryptocurrency offer is that, unlike fully featured crypto exchanges, eToro does not offer cryptocurrency deposits. This means that while you can withdraw crypto on eToro, you cannot deposit cryptocurrencies on the platform.

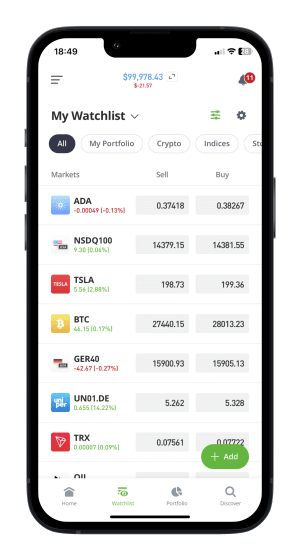

Trading Crypto on eToro

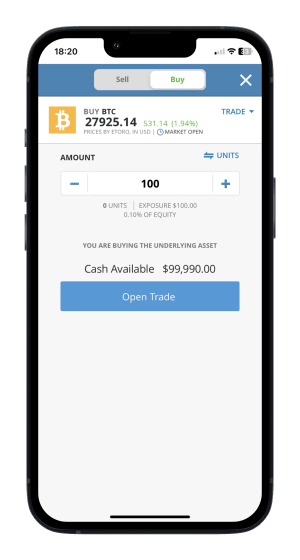

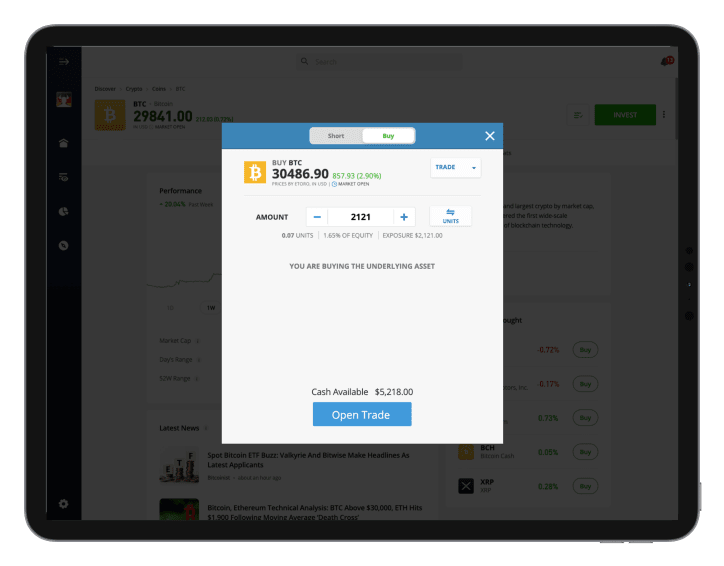

The eToro broker offers an easy-to-use trading interface that allows users to sell and buy cryptocurrencies without any complicated trading views.

Buying real cryptocurrencies on eToro's trading interface is as easy as entering the amount of USD you'd like to buy crypto for, selecting a leverage of 1x, and clicking "Open Trade".

By selecting "Trade" on the top right of eToro's trading view, a simple market order is being executed on eToro that buys or sells the selected cryptocurrency at the current market price.

In combination with choosing leverage of 1x, this "Trade"-method is the easiest way to buy real crypto on eToro with no room for error, even for inexperienced crypto investors.

Picking "Order" on the other hand makes it possible to place limit orders for cryptocurrencies on eToro that allow for buying or selling crypto at a specified price, possibly above or below the current market price.

Note that the "Order"-method of trading crypto on eToro is highly useful but also requires lots of caution, as mistakenly entering a false limit price may result in a loss of funds.

You can see that despite having a simple trading interface, eToro offers the most important trading features for cryptocurrencies that will satisfy crypto investors, ranging from beginners to advanced traders.

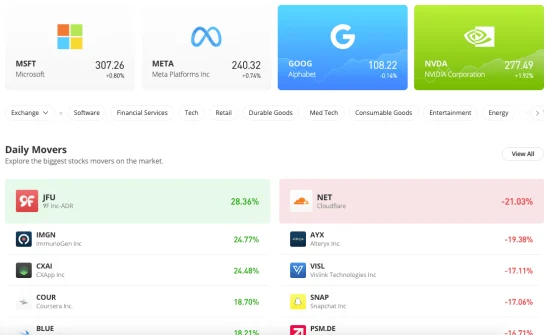

Stocks & ETFs on eToro

On eToro, users can trade a selection of 3000+ stocks and 300+ ETFs with eToro's simple trading interface that allows for both CFD trading as well as spot trading, where users buy the actual underlying stocks and indices.

Trading stocks and ETFs involves 0% trading fees on eToro, which is highly customer-friendly and makes investing in securities highly cost-efficient on eToro.

eToro lists all major stock titles like Apple to Microsoft, Tesla, and Google as well as many small caps and ETFs such as the S&P500 and NASDAQ100.

To make investing accessible to everyone, eToro offers fractional investing on their platform which allows users to invest any amount of money into stocks and ETFs without having to buy entire shares at high prices.

While this comes with some caveats such as not being able to transfer those fractional shares to other brokers, fractional trading allows any user to start trading on eToro with ease even with small amounts of $10 onwards.

By offering not only a wide range of cryptocurrencies but also all major stocks and indices, eToro is a great all-rounder platform for easy investing in all sorts of assets.

eToro Fees

There are different trading fees on eToro depending on the traded assets, as well as on the type of trading - spot or CFDs.

| Asset | eToro Trading Fee |

|---|---|

| 🪙 Spot Cryptoassets | 1% |

| 📄 Stocks, ETFs | 0% |

| 🔮 CFDs | Variable: Rather moderate |

While the trading fees on stocks and ETFs on eToro are exceptionally low at 0%, trading crypto on eToro comes with a fee of 1% that is rather moderate compared to dedicated cryptocurrency exchanges.

As a final test result, we have given eToro a rating of 89/100 for trading fees on the platform.

When it comes to account fees in general, eToro implements an inactivity fee of currently 10$ per month after 1-year inactivity, which is also commonly seen among other brokers.

Additionally, withdrawing money from eToro to your bank account comes with an extra service fee of 5$, which is a negative point in our test of eToro as it potentially discourages investors from taking profits.

Furthermore, withdrawing cryptocurrencies from eToro to your eToro Money wallet is charged a fee relative to the withdrawn crypto, which is also unfortunately high compared to other crypto brokers and exchanges.

Overall, we have found in our eToro test that trading fees on eToro are satisfactory, while account fees are rather high.

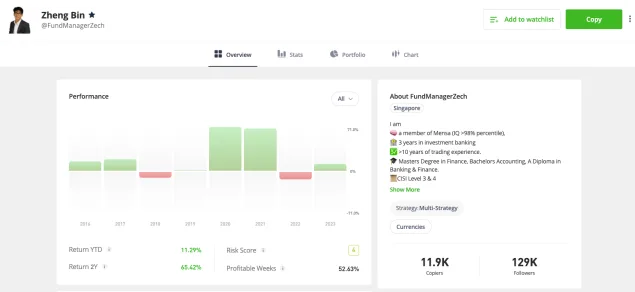

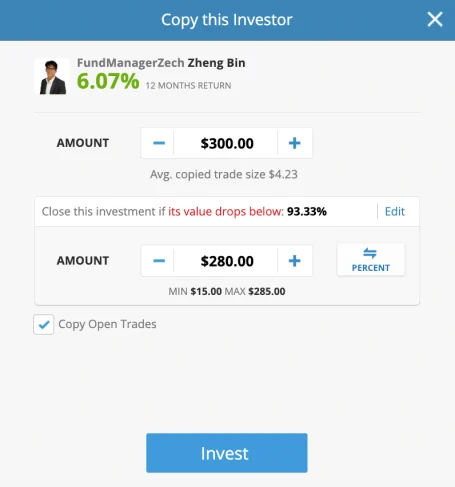

eToro Copy Trading tested

Something that cannot be left unmentioned in our eToro test review is the broker's unique selling feature called Copy Trading or Social Trading.

This feature allows eToro investors to copy the portfolios of other investors who they believe to be more experienced and more likely to make a profit.

In practice, investors on eToro have their own investing profile, similar to a social media profile, that displays their portfolio together with their past investing results. Other users can visit a user's eToro profile, and simply copy their portfolio with a dedicated amount of money.

Whether a user deems other users to be more successful and reliable investors themselves or simply wants to follow the investing strategy of his friends, eToro's Copy Trading allows for all of that with no additional fees.

To copy someone else's investing portfolio on eToro, users simply navigate to other users' profiles, select "Copy" and invest their desired USD amount - just as simple as investing in any other asset on eToro.

In addition to simply copying other investors' portfolios, Social Trading on eToro also includes a social media-like feed where eToro investors share their thoughts about the world of investing. Hence, many investors use eToro as a go-to social media platform for insights and opinions about markets.

Considering Social Trading on eToro has a big community of active investors and comes with no additional charges for copying someone else's portfolio, this feature comes out as a major pro in this eToro review that sets the broker apart from others.

From my personal experience, because being copied on eToro may result in financial benefits, many investors on eToro seem to be maintaining risky portfolios to achieve the highest possible ROI so that others copy them. Hence, finding relatively stable investors to copy on eToro is not trivial.

eToro Rating

To summarize the pros and cons of eToro including the experiences we made in testing this broker, we created an eToro rating 2026.

The main points in which we have rated the broker as part of this eToro test are registration speed, simplicity, tradable cryptocurrencies, trading fees, and investing features.

| eToro rating | |

|---|---|

| Registration Speed | 93% |

| Usage | 91% |

| Coins | 90% |

| Fees | 89% |

| Features | 96% |

| Final Rating | 91% |

Overall, eToro has received a final rating of 91/100 in our test. With a relatively high rating score, eToro can be considered one of the better crypto- and stock brokers.

Final Opinion: is eToro good?

eToro plays a very unique role in making investing accessible, as the broker not only offers trading of all major assets at acceptable fees and high regulatory safety but also supports easily the most payment methods out of all brokers we tested so far.

At the same time, eToro's Social Trading and more advanced trading features make eToro an interesting investing platform even for more experienced investors that do not necessarily rely on eToro's wide selection of payments and easy interface.

We recommend eToro for a fast and simple start into investing in crypto, the interesting feature of Social Trading, and trading stocks & ETFs at 0% fees.

In our eToro review, we have concluded that investing on eToro is not only easy but also rich in features, as eToro also offers leverage trading and short selling in addition to simple spot investments.

Considering our final eToro rating of 91/100, eToro is one of the best and most recommended brokers for trading cryptocurrencies and stocks we've tested so far.

Risk disclaimer

eToro is a multi-asset platform that offers investing in stocks, cryptoassets, as well as trading CFDs.

Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision.

Copy trading is a portfolio management service, provided by eToro (Europe) Ltd., which is authorized and regulated by the Cyprus Securities and Exchange Commission.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.